Financing local nature recovery in Oxfordshire Case study

Understanding the scale of the opportunity to fund nature recovery with offsite Biodiversity Net Gain (BNG) payments.

The newly formed Local Nature Partnership (LNP) aims to radically enhance nature, its positive impact on our climate and the priority it is given, helping make Oxfordshire a place where people and nature thrive.

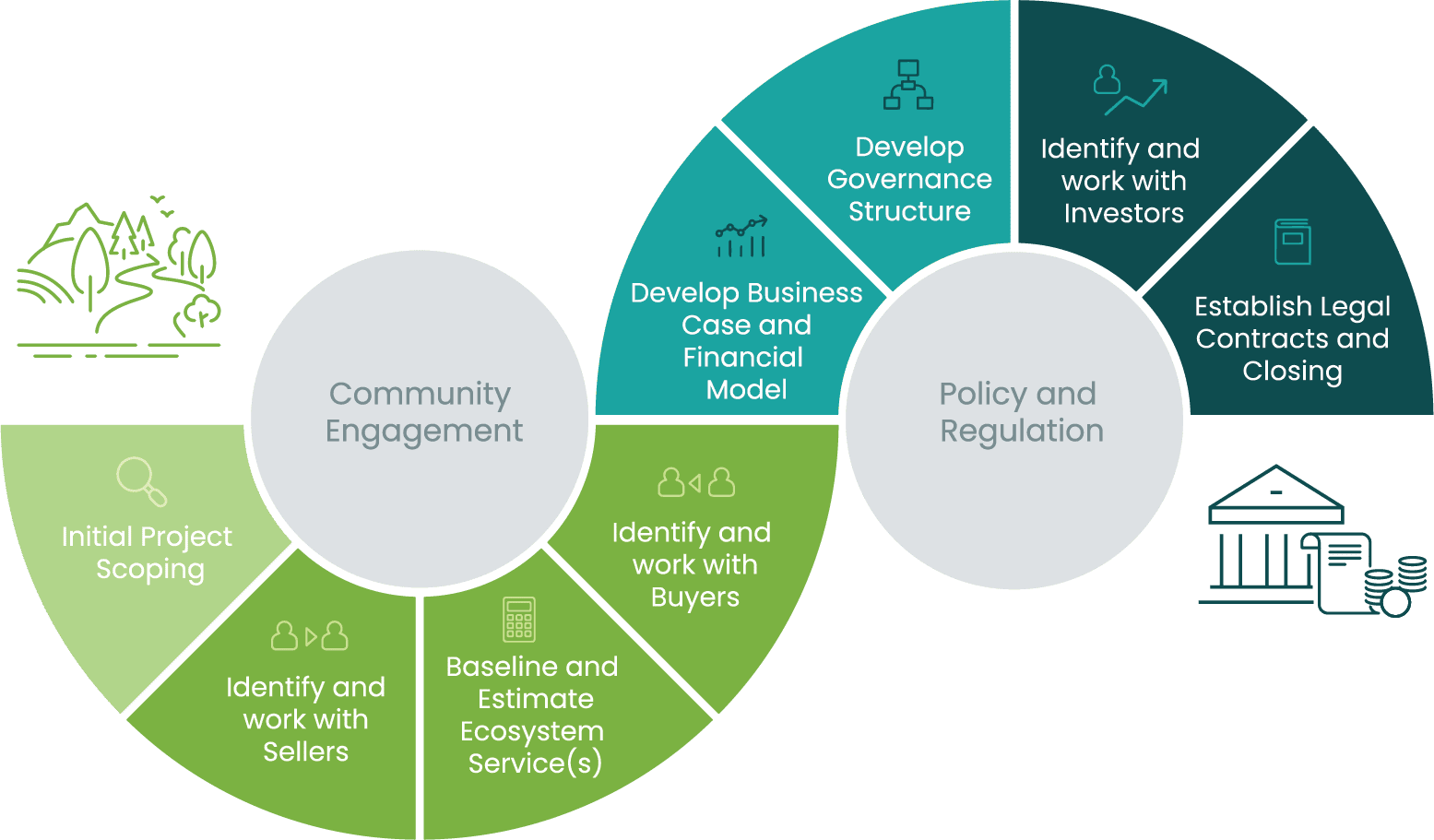

The Finance Gap for UK Nature report revealed a £56 billion in investment above current public sector commitments is required for the UK to meet nature-related outcomes in the next ten years. Natural Capital Investment seeks to leverage private finance to deliver nature recovery. This investment can be repaid by selling credits resulting from the nature recovery work. The LNP expects to focus on two types of credit – Biodiversity Net Gain credits and Carbon Credits – although more exist, resulting from tokenisation of water quality, flood risk reduction, public access and even emerging, general ‘nature recovery’ tokens.

Now is the right time to press ahead with a county-level framework, and Oxfordshire has an opportunity to develop an England-leading approach. A county-wide approach would help meet the need to reduce risk for the Local Planning Authorities regarding the introduction of mandatory Biodiversity Net Gain legislation in November 2023 arising from a lack of offsite delivery projects.

The Leverhulme Centre for Nature Recovery is pleased to be working with the LNP, by providing financial expertise and support for these plans.

As part of the LNP’s work on Natural Capital Investment, The Leverhulme Centre for Nature Recovery supported an intern, Isobel Hawkins, to investigate the potential revenue that could be generated over the next ten years through purchase of Biodiversity Net Gain (BNG) offsets by developers in Oxfordshire, and the extent to which this could contribute to the estimated costs of nature recovery.

Outcomes

We compared potential BNG revenue with the costs of creating sufficient areas of semi-natural habitats in strategic locations (e.g. within Oxfordshire’s Nature Recovery Network) to meet the 30×30 target, and maintaining those habitats for 30 years. These costs are estimated at £800 million, but this excludes the costs of protecting and monitoring the sites, and any additional costs for organisations that wish to purchase land or compensate landowners for lost opportunity costs. These are not the full costs of nature recovery in its broadest sense, as they do not take account of the cost of restoring species populations to sustainable levels, including the cost of recovering any species and habitats lost as a result of the development that gives rise to the BNG revenue. The estimates are simply intended to help organisations involved in nature recovery to understand the potential size of the BNG market, to inform future investment plans.

We estimated that if the minimum BNG of 10% is adopted, the BNG offset market could finance a maximum of 13% of the costs of creating additional habitats to meet the 30×30 target. Around 47,000 biodiversity units would be required to offset the impacts of the developments expected in Oxfordshire over the next ten years. The majority of these units are required to compensate for habitat loss due to development, with only 4,309 representing the expected 10% net gain, worth an estimated £108 million, just 13% of the estimated cost of habitat creation to meet the 30×30 target.

The estimates depend on assumptions about the proportion of biodiversity units that are delivered off-site, outside the development boundary, and could therefore be used to fund the restoration of strategically important sites that could contribute to the 30×30 target. On-site habitat creation can also have biodiversity benefits but there is currently no legal mechanism to enforce long term monitoring and protection, as required in order to count towards the 30×30 target. At least 9% of biodiversity units need to be delivered off-site in order to deliver the £108 million of revenue that could contribute towards nature recovery. However, currently, only 7% of biodiversity units are delivered off-site, which would generate around £83 million in offset funding over the next 10 years, just 10% of the estimated habitat creation costs.

These estimates would increase if a larger target for BNG was adopted. For example, some councils elsewhere in England have adopted targets of 20% or above. If this was done in Oxfordshire, then BNG could contribute up to 26% of expected nature recovery costs (provided that at least 17% of biodiversity units are delivered off-site).

When additional costs of protecting and monitoring new habitats or any necessary land purchase or opportunity costs are taken into account, the true proportion of nature recovery that the BNG market can fund (for a 10% BNG target) is likely to be lower than the maximum estimate of 13%. Whilst Oxfordshire is the focus of this case study, it provides a useful illustration of the factors influencing the BNG offset market and its ability to finance nature recovery, which could be more widely applicable to other councils in England.

Project outputs

- Finance

The potential contribution of revenue from Biodiversity Net Gain offsets towards nature recovery ambitions in Oxfordshire

There is a major funding gap for delivering the UK’s nature recovery ambitions, including meeting the national and international ‘30×30’ target (30% of land protected and managed for nature by 2030). This work aimed to investigate the potential revenue that could be generated over the next ten years through purchase of Biodiversity Net Gain (BNG) offsets by developers in Oxfordshire, and the extent to which this could contribute to the estimated costs of nature recovery.

We compare potential BNG revenue with the costs of creating sufficient areas of semi-natural habitats in strategic locations (e.g. within Oxfordshire’s Nature Recovery Network) to meet the 30×30 target, and maintaining those habitats for 30 years. These costs are estimated at £800 million, but this excludes the costs of protecting and monitoring the sites, and any additional costs for organisations that wish to purchase land or compensate landowners for lost opportunity costs. Also, these are not the full costs of nature recovery in its broadest sense, as they do not take account of the cost of restoring species populations to sustainable levels. In particular, this analysis does not consider the cost of recovering any species and habitats lost as a result of the development that gives rise to the BNG revenue, i.e. it is assumed that the compensatory habitats created through BNG will successfully replace those lost and will prevent any loss of associated species. The estimates are simply intended to help organisations involved in nature recovery to understand the potential size of the BNG market, to inform future investment plans.